Excess Basis 1031 Exchange . Buy building b for $500,000. when a property is acquired in a sec. knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. if sold, a would have gain of $300,000 but instead did a 1031 exchange. the general basis concept is that the new property purchased is the cost of that property minus any gain you. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. The cost basis of a 1031 exchange can be calculated in a few steps. Identify the property you intend to acquire as the replacement property in the 1031 exchange.

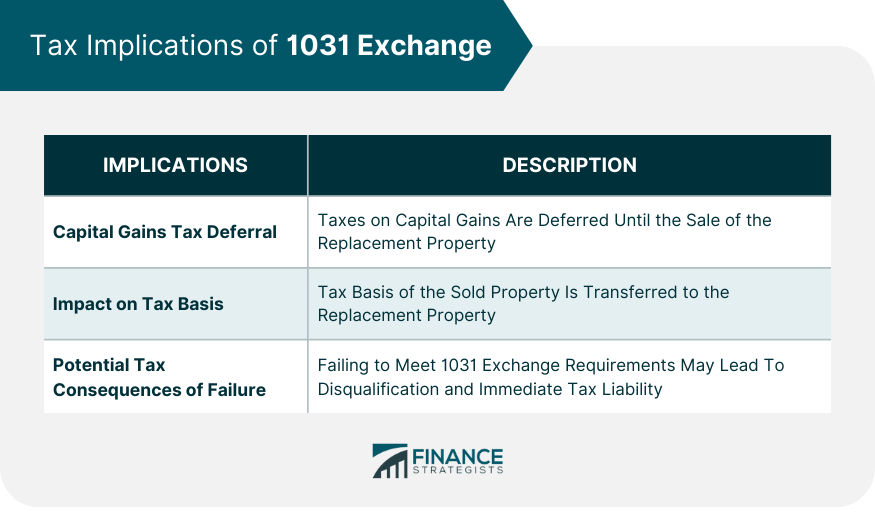

from www.financestrategists.com

The cost basis of a 1031 exchange can be calculated in a few steps. if sold, a would have gain of $300,000 but instead did a 1031 exchange. when a property is acquired in a sec. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. Identify the property you intend to acquire as the replacement property in the 1031 exchange. knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. Buy building b for $500,000. the general basis concept is that the new property purchased is the cost of that property minus any gain you.

1031 Exchange Rules Overview, Types, & Special Cases

Excess Basis 1031 Exchange The cost basis of a 1031 exchange can be calculated in a few steps. when a property is acquired in a sec. Buy building b for $500,000. The cost basis of a 1031 exchange can be calculated in a few steps. knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. Identify the property you intend to acquire as the replacement property in the 1031 exchange. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. the general basis concept is that the new property purchased is the cost of that property minus any gain you. if sold, a would have gain of $300,000 but instead did a 1031 exchange.

From www.stessa.com

6 Steps to Understanding 1031 Exchange Rules Stessa Excess Basis 1031 Exchange knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. the general basis concept is that the new property purchased is the cost of that property minus any gain you. The cost basis of a 1031 exchange can be calculated in a few steps. Buy building b for $500,000. the 481. Excess Basis 1031 Exchange.

From willowdaleequity.com

What is a 1031 Exchange and Why is it One of The Most Powerful Tools in Excess Basis 1031 Exchange Identify the property you intend to acquire as the replacement property in the 1031 exchange. when a property is acquired in a sec. Buy building b for $500,000. if sold, a would have gain of $300,000 but instead did a 1031 exchange. the general basis concept is that the new property purchased is the cost of that. Excess Basis 1031 Exchange.

From 1031-exchange-rules.com

Basic 1031 Exchange Rules 1031 Exchange Rules 2021 Excess Basis 1031 Exchange knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. The cost basis of a 1031 exchange can be calculated in a few steps. Buy building b for $500,000. the general basis concept is that the new property purchased is the cost of that property minus any gain you. Identify the property. Excess Basis 1031 Exchange.

From www.jrw.com

Introduction to the 1031 Exchange JRW Investments Excess Basis 1031 Exchange The cost basis of a 1031 exchange can be calculated in a few steps. if sold, a would have gain of $300,000 but instead did a 1031 exchange. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. the general basis concept is that. Excess Basis 1031 Exchange.

From www.fscap.net

Understanding Basis in a 1031 Exchange 1031 Exchange Net Lease Excess Basis 1031 Exchange The cost basis of a 1031 exchange can be calculated in a few steps. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. Identify the property you intend to acquire as the replacement property in the 1031 exchange. knowing how to calculate cost basis. Excess Basis 1031 Exchange.

From www.youtube.com

1031 Exchange Explained YouTube Excess Basis 1031 Exchange the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. when a property is acquired in a sec. if sold, a would have gain of $300,000 but instead did a 1031 exchange. The cost basis of a 1031 exchange can be calculated in a. Excess Basis 1031 Exchange.

From www.doorloop.com

1031 Exchange Timeline What You Need to Know [2023 Edition] Excess Basis 1031 Exchange knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. the general basis concept is that the new property purchased is the cost of that property minus any gain you. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially. Excess Basis 1031 Exchange.

From markjkohler.com

When and How to use the 1031 Exchange Mark J. Kohler Excess Basis 1031 Exchange Buy building b for $500,000. the general basis concept is that the new property purchased is the cost of that property minus any gain you. if sold, a would have gain of $300,000 but instead did a 1031 exchange. the 481 adjustment from a study performed on a property that is to be traded in a 1031. Excess Basis 1031 Exchange.

From www.financestrategists.com

1031 Exchange Rules Overview, Types, & Special Cases Excess Basis 1031 Exchange knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. The cost basis of a 1031 exchange can be calculated in a few steps. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. the general basis concept. Excess Basis 1031 Exchange.

From provident1031.com

Guide To A 1031 Exchange Provident 1031 Excess Basis 1031 Exchange knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. the general basis concept is that the new property purchased is the cost of that property minus any gain you. Buy building b for $500,000. if sold, a would have gain of $300,000 but instead did a 1031 exchange. Identify the. Excess Basis 1031 Exchange.

From www.adventuresincre.com

1031 Exchange Overview and Analysis Tool Adventures in CRE Excess Basis 1031 Exchange if sold, a would have gain of $300,000 but instead did a 1031 exchange. when a property is acquired in a sec. Identify the property you intend to acquire as the replacement property in the 1031 exchange. Buy building b for $500,000. The cost basis of a 1031 exchange can be calculated in a few steps. the. Excess Basis 1031 Exchange.

From www.winthcowealthmanagement.com

1031 Exchange Timeline Learn The Rules And The Requirements 2022 Excess Basis 1031 Exchange Buy building b for $500,000. Identify the property you intend to acquire as the replacement property in the 1031 exchange. the general basis concept is that the new property purchased is the cost of that property minus any gain you. the 481 adjustment from a study performed on a property that is to be traded in a 1031. Excess Basis 1031 Exchange.

From www.innovationrentals.com

Using the 1031 Exchange Excess Basis 1031 Exchange Identify the property you intend to acquire as the replacement property in the 1031 exchange. knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. Buy building b for $500,000. the general basis concept is that the new property purchased is the cost of that property minus any gain you. if. Excess Basis 1031 Exchange.

From theclose.com

How to Explain 1031 Exchange Rules to Your Clients Excess Basis 1031 Exchange the general basis concept is that the new property purchased is the cost of that property minus any gain you. knowing how to calculate cost basis after a 1031 exchange is crucial for future tax implications. Buy building b for $500,000. if sold, a would have gain of $300,000 but instead did a 1031 exchange. the. Excess Basis 1031 Exchange.

From taxedright.com

5 things you need to know about 1031 exchanges Taxed Right Excess Basis 1031 Exchange the general basis concept is that the new property purchased is the cost of that property minus any gain you. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. when a property is acquired in a sec. if sold, a would have. Excess Basis 1031 Exchange.

From www.tylercauble.com

What Is A 1031 Exchange? (in Real Estate) — The Cauble Group Excess Basis 1031 Exchange the general basis concept is that the new property purchased is the cost of that property minus any gain you. if sold, a would have gain of $300,000 but instead did a 1031 exchange. Identify the property you intend to acquire as the replacement property in the 1031 exchange. The cost basis of a 1031 exchange can be. Excess Basis 1031 Exchange.

From fitsmallbusiness.com

Section 1031 Exchange The Ultimate Guide to LikeKind Exchange Excess Basis 1031 Exchange the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. the general basis concept is that the new property purchased is the cost of that property minus any gain you. The cost basis of a 1031 exchange can be calculated in a few steps. . Excess Basis 1031 Exchange.

From velocity1031.com

1031 EXCHANGE GUIDE Excess Basis 1031 Exchange if sold, a would have gain of $300,000 but instead did a 1031 exchange. the 481 adjustment from a study performed on a property that is to be traded in a 1031 exchange can potentially serve two. Identify the property you intend to acquire as the replacement property in the 1031 exchange. the general basis concept is. Excess Basis 1031 Exchange.